Second-Hand, First Choice: The Psychology of Recommerce

5 Minute Read

This report is a must read for businesses, it includes consumer and industry insights, plus actionable strategies to navigate the evolving landscape of recommerce.

Click here to explore working with Retail Economics for publishing world class thought leadership research like this.

Contents:

-

Foreword

-

Introduction

-

Methodology

-

Section one: Recommerce Revolution: Used Market Landscape & Dynamic

-

Section two: Consumer Drivers and Characteristics: The Five Motivational Pillars of Recommerce

-

Section three: Megatrends Reshaping the Recommerce Industry

-

Conclusion

-

About Retail Economics and MPB

Introduction

The 'Recommerce Revolution' is not merely a trend; it's a transformative force that will fundamentally reshape the retail and consumer landscape moving forward. This evolution is not merely a passive shift; it's a dynamic force, reshaping the way society thinks about retail, sustainability, and consumer behaviour. At its core, recommerce champions a circular economy where product lifecycles are extended, waste is reduced, and sustainability values are elevated to centre stage.

Recommerce (short for reverse commerce) refers to the buying and selling of previously owned items, which can include a wide range of products such as clothing, electronics, furniture, and more. Today, the recommerce market (excluding automotive) is already worth £165 billion on a global scale and is forecast to grow almost 80% by 2028 across the US, UK, France, and Germany, representing a five-year compound annual growth rate (CAGR) of 12.1%. The UK recommerce market is worth approximately £6.5 billion today and is forecast to nearly double in size over the next five years, reaching £12.4 billion in 2028.

Historically, the sector was confined to garage and car boot sales, charity shops, second-hand markets, and the like. With the advent of the internet, online classified and generalist platforms exploded onto the market (e.g., Craigslist and eBay). Today, we are traversing through a third wave of activity characterised by an increasing number of specialist marketplaces like musicMagpie, MPB, and Watchfinder.

Unlike the 1990s, powerful market drivers are now coalescing, propelling the industry to new heights. Drivers such as sustainability, the economy, societal and retail trends are accelerating market movements, backed by advances in technology that are supercharging critical infrastructure. Sustainability concerns and the rising cost-of-living are fierce motivational factors currently reshaping consumer behaviour for both buyers and sellers within the recommerce market.

This report delves into the key themes concerning recommerce, unearthing vital industry and consumer insights that businesses can implement in their strategies as recommerce continues to evolve. There are three parts: Section 1 looks at the general market landscape; section 2 explains consumer motivational drivers and characteristics, and section 3 delves into five key megatrends shaping the future of the market.

Section one: Recommerce Revolution:

Used Market Landscape & Dynamics

The recommerce market is undergoing a profound transformation and will remain a focal area of retail for the foreseeable future. It is primarily driven by sustainability concerns and the rising cost-of-living—two powerful factors. The barriers to entry for buying and selling pre-owned goods have significantly decreased, with digital playing a key role in simplifying processes, helping to democratise recommerce.

This burgeoning ecosystem is not only altering consumer behaviour but rewriting the rules of engagement for traditional retailers. It's an area garnering considerable attention, with exploding demand giving rise to a plethora of general and specialised platforms. This section explores the market's characteristics, size, and the remarkable growth potential.

Recommerce: The £165 Billion Industry

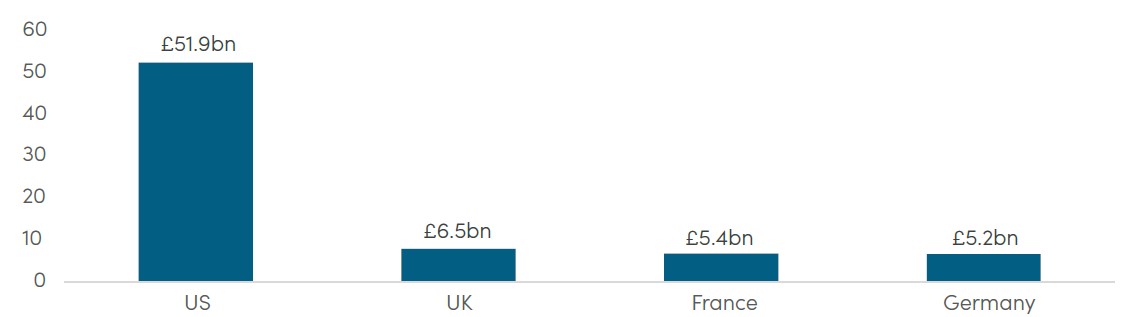

Today, the recommerce market (excluding automotive) stands as a colossal £165-billion-plus global industry. In the US alone, sales of used goods are valued at almost £52 billion, making it the largest recommerce market worldwide. For comparison, the largest European markets combined account for over £17 billion, with the UK leading the way at £6.5 billion, followed by France at £5.4 billion and Germany at £5.2 billion. Cumulatively, these four recommerce markets surpass the entire retail market of Austria, which is the 10th largest European market in total retail sales.

The UK's recommerce market is expected to reach £12.4 billion by 2028, nearly doubling in size relative to today and significantly outpacing the growth of the traditional retail market.

Fig 1: Recommerce market size by country

Source: MPB, Retail Economics

These weighty numbers not only highlight the substantial financial opportunities within recommerce but also underscore the explosive demand for buying and selling used goods.

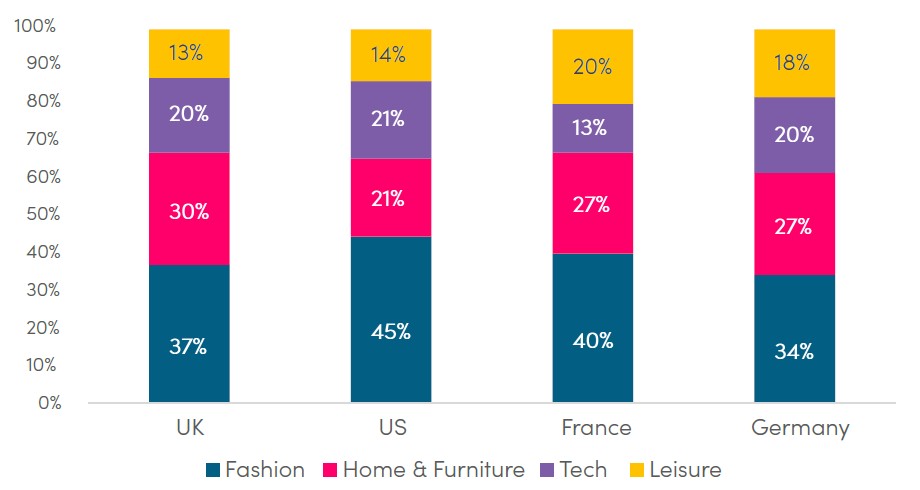

Fashion leads the way

Fashion currently reigns supreme in the realm of used goods. Across the four countries included in our research, approximately £4 in every £10 spent on used goods is allocated to apparel (Fig. 2). The extensive array of recommerce platforms and resale players in the fashion sector provides consumers with extensive choices and accessibility. Furthermore, the rapid turnover of stock, driven by fast fashion and shorter ownership periods, is perpetuated by flash trends within the fashion industry.

Homewares and Furniture claim a substantial share of the recommerce market, particularly in Europe. The UK leads in this category, holding a 30% share of total recommerce spend, amounting to nearly £2 billion annually in these categories.

The Tech sector, encompassing items such as laptops, phones, and cameras, maintains a robust presence across countries, capturing around one-fifth of the market share. This reflects a strong demand for used tech equipment.

Leisure is the smallest sector, incorporating items such as toys, games, music, and sporting equipment.

Fig 2: Fashion dominates recommerce categories

Source: MPB, Retail Economics

Consumer Engagement in Recommerce

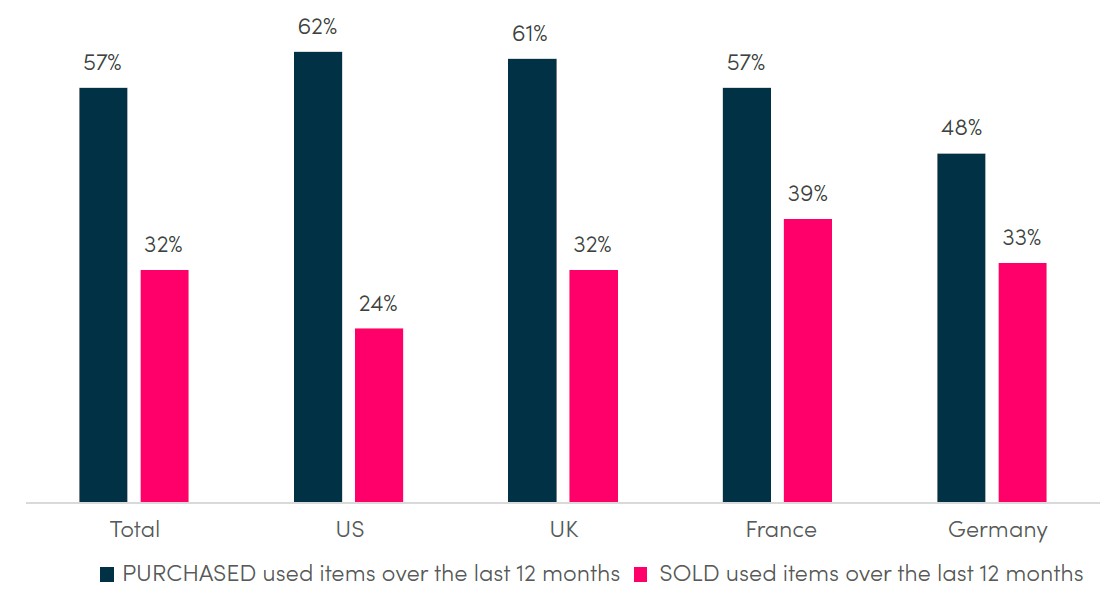

Almost three in four (71%) consumers either bought or sold used goods in the past year. Among these, over half (57%) identified as 'buyers,' while one in three (32%) took on the role of 'sellers.' Overall, approximately one in five (17%) engaged in both buying and selling second-hand items on a regular basis, earning the title of 'used enthusiasts.'

The research brings to light regional disparities. The US and UK boast the highest penetration rates for buying used goods over the past year, with three in five shoppers participating (Fig. 3). In contrast, France emerges as the leader in active selling, with an impressive 39% of consumers recently engaging in selling used items. This equates to around 20.5 million sellers each year in France.

Fig 3: US and UK have the highest rates for purchasing used products

Source: MPB, Retail Economics

Regarding consumer spending per capita, this also varies significantly. Here, the US leads with per capita spending of £196 (Fig. 4). The UK has the highest per capita spend in Europe at £122, while France and Germany follow at £103 and £75, respectively. Disparities reflect different levels of market maturity, cultural attitudes towards second-hand, and prevailing economic conditions.

To access more data from section one, download the full report at the top of this page

Section two: Consumer drivers and

characteristics: The five motivational pillars of recommerce

The recommerce market is experiencing a significant evolution and is poised to increase its prominence within the retail landscape. As this ecosystem expands, it’s critical for retail brands to deeply understand the motivating factors driving consumer behaviour, not only to shape marketing strategies, but to capitalise on consumers selling second-hand too.

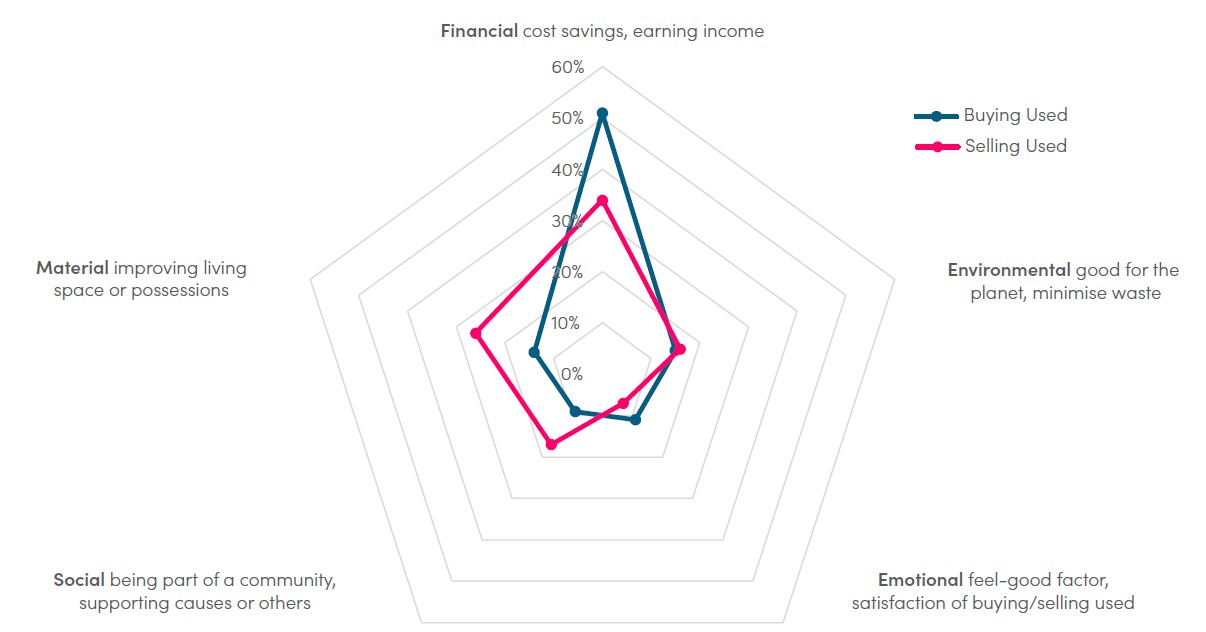

Value the primary motivation

Our research shows that deriving better value and cost savings is the primary motivating factor for consumers buying used. Over half of shoppers (52%) stated ‘financial reasons’ to validate this.

The value for money afforded by used goods is an attractive proposition for all households, irrespective of income, particularly given persistent cost of living concerns and elevated interest rates across Europe and North America. Against this backdrop, the recommerce market stands out as a budget-friendly alternative to buying new.

When it comes to selling, earning income is the main driver, with over a third (34%) of shoppers opting to sell second-hand products to prop up finances.

Beyond financial motivations, environmental concerns are the next biggest motivating factor for buying used. Here, recommerce offers consumers a viable solution to live more sustainably, reducing environmental impact and waste.

Fig 12: Selling motivations more varied than buying

Source: MPB, Retail Economics

Material motivations can also play a key role. These encompass practical reasons such as demand for unique or vintage items. It can also empower buyers to pursue personal interests or specific lifestyles. From a seller’s perspective, the motivation often lies in decluttering living spaces.

Buying and selling used can also deliver social and emotional benefits, from connecting people and building like-minded communities, to creating a feel-good factor and gaining satisfaction from buying/selling used (or supporting others who perhaps cannot afford to buy brand new)

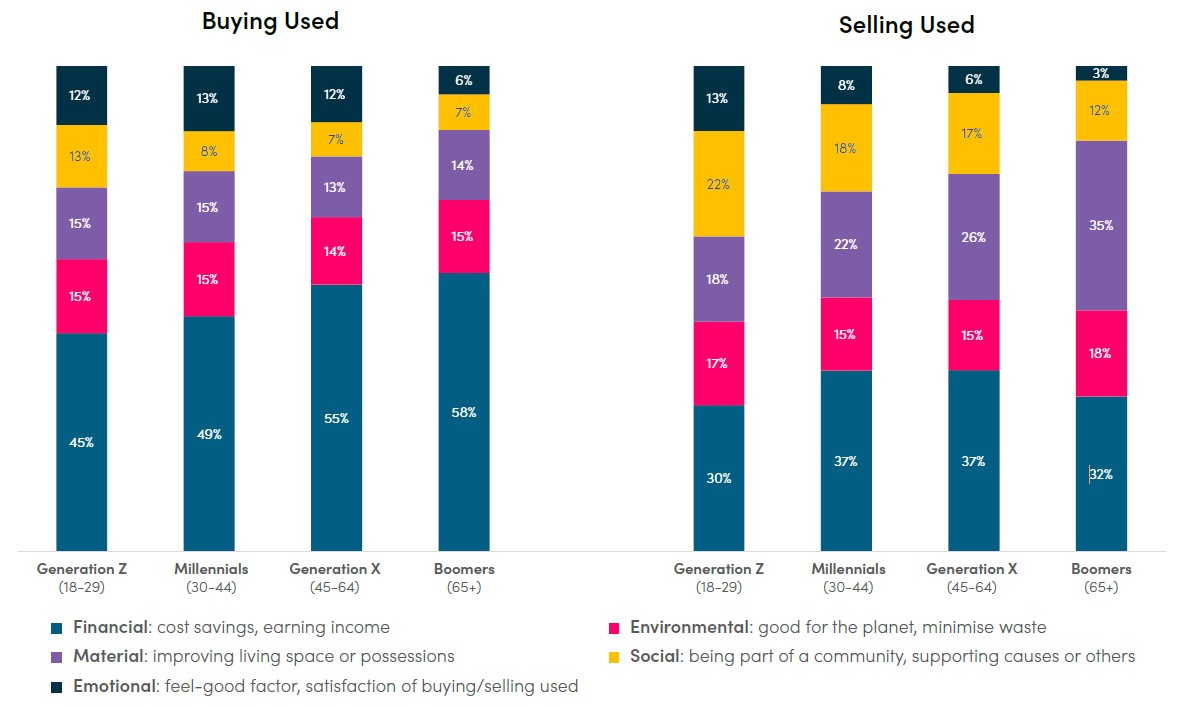

Motivations by age

Younger Generations (Gen Z and Millennials): Embracing Environmental and Social Factors

Gen Z and Millennials exhibit a more varied mix of motivations when it comes to buying and selling used items. They still give priority to financial benefits but also demonstrate strong environmental and social concerns. They express a desire to engage with communities, support causes, and make a broader social and environmental impact through their participation in recommerce activities.

Fig 13: Used motivations by age

Source: MPB, Retail Economics

Older Generations (Gen X & Boomers): Focus on Financial Prudence & Decluttering

Conversely, Gen X and Boomers share simpler motivations, focusing on financial gains and the practical aspects of finding unique items or decluttering as they look to downsize or clear out years of accumulated possessions.

To access more data from section two, download the full report at the top of this page